By Kyle Swain, Retail Director Australia & New Zealand, Lpc Cresa

This past weekend, the Age newspaper in Melbourne published a piece declaring “Weekend foot traffic nears pre-pandemic level” and quoted the Deputy Lord Mayor saying that “every extra person in the city represented another opportunity for CBD businesses that had done it tough throughout the past year”.

In Melbourne’s CBD shopping precincts, retail businesses rely on foot traffic to survive. Restaurants and café’s have been decimated over the period since the pandemic first started to impact on our lives in March of 2020 and retailers in the same precincts and including CBD Shopping Centres like Emporium and Melbourne Central have also suffered badly from the lockdowns and the lack of foot traffic in the CBD as office workers continue to work from home despite shops re-opening for trade and all government support such as jobkeeper and legislation providing for rental relief ceasing.

The experience is the same in Sydney and Brisbane’s CBD’s although Melbourne certainly suffered the most with extended lockdowns and subsequent shorter lockdowns. The article in The Age reported a “Buzz is coming back to Melbourne” – potentially very good news for many businesses facing paying full rent plus repayment of ‘deferred rent’ from the pandemic period, and still experiencing vastly reduced turnover compared to pre-pandemic sales.

What does the real data say?

Managing Director of Lpc Cresa’s Victorian office, Dylan O’Donnell has compiled data from the City of Melbourne’s foot traffic sensors to help our clients understand the true state of play at the moment, and to use as leverage in current discussions with landlords on behalf of clients looking to lease new premises, renew existing rents, and for those who desperately need ongoing rental support to avoid ‘the cliff’.

The analysis focussed on the hours of 10am to 9pm only which is obviously the most relevant times for retail businesses to capture the foot traffic. Ninety percent of foot traffic in Bourke Street Mall occurs between these hours and eighty percent of foot traffic at Melbourne Central and Flinders Station is captured by the sensors between those hours.

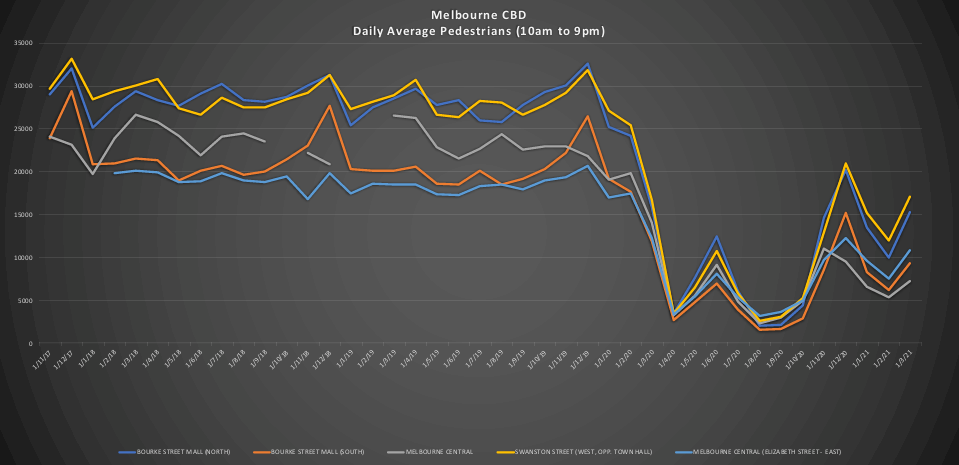

The table below shows foot traffic at five key retail precincts within Melbourne’s CBD since November 2017.

Source: http://www.pedestrian.melbourne.vic.gov.au

The graph clearly displays the dramatic decline in foot traffic in these precincts during the ‘pandemic response period’ as shops were closed, and workers abandoned City offices to ‘work from home’. In the middle of 2020, there was a slight recovery after the first lockdown but without workers returning to offices, foot traffic remained well below pre pandemic levels. The devastating second lockdown dropped traffic to below the worst point during the initial lockdown before another recovery period over the New Year.

The graph also clearly shows what has been experienced by retailers in Brisbane also – “The short, sharp lockdown in mid-February delivered a setback in pedestrian numbers for the whole month which highlights the potential impact of future shorter lockdowns,” said Mr O’Donnell.

This prolonged impact needs to be understood by politicians when deciding to declare a ‘Three Day lockdown’ in response to minor outbreaks, and it needs to be understood by Landlords when tenants are seeking abatements as relief from extremely difficult trading circumstances.

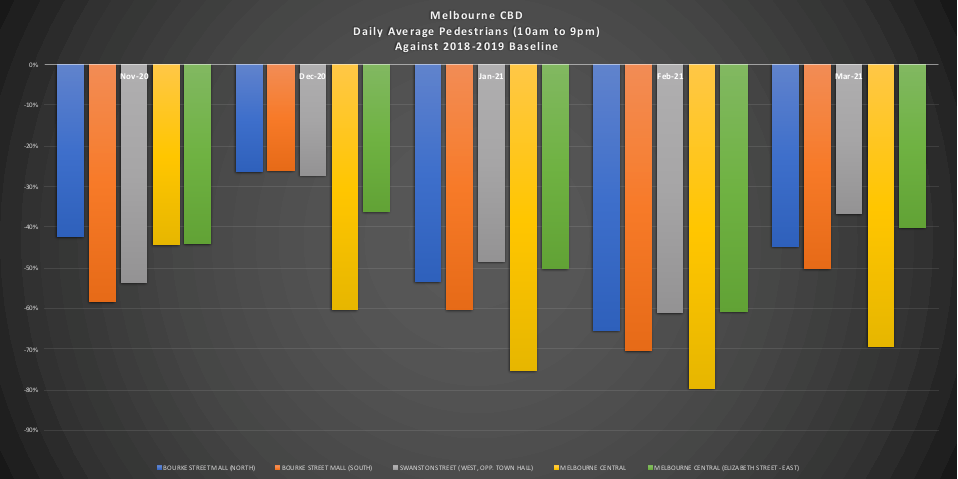

The graph below directly compares foot traffic in the same five retail precincts through Melbourne’s CBD from November 2020 through til March of 2021 compared to the pre-pandemic figures from the same months over 2018-2019.

Source: http://www.pedestrian.melbourne.vic.gov.au

The data shows the daily pedestrian traffic in in the CBD was still tracking consistently 40% below pre-pandemic levels in the CBD and close to 70% below pre-pandemic levels for Melbourne Central.

What learnings do we take away from this?

The report in The Age over the weekend declaring a “Buzz” returning to Melbourne’s CBD was comparing specific weekend peak times and pedestrian traffic driven by school holidays, the Melbourne International Comedy Festival and a major exhibition at the Melbourne Art Gallery. Although pedestrian numbers were up by 187% on the 4-week average at the Arts Centre, even with these events to encourage people to enter the CBD area, the Age reported numbers achieving 93% of pre pandemic levels.

When asked what we should take home from the article in the paper compared to the pedestrian data Lpc Cresa has compiled, Mr O’Donnell said “It may well be stating the obvious, but until such time as office workers, international students and the combination of domestic and international travel returns to pre-pandemic levels, we would anticipate pedestrian traffic servicing CBD retail precincts will continue to track well below pre-pandemic levels”.

Despite the legislation around the code expiring and jobkeeper ending, every indicator is that the impact of Covid-19, particularly in the major CBD shopping precincts, will continue to be significantly impacted throughout 2021 and possibly 2022.

Lpc Cresa’s advice to tenants is that they need to explore every opportunity to realign lease terms to ensure continued viability of their business. For businesses that find themselves struggling, like any time during their lease, they need to have an honest conversation with their landlord and discuss rental abatements and other available options.

There are numerous other options for negotiating short term or permanent variations to your lease obligations to survive the ongoing impacts of the pandemic which could be explored depending on the specific circumstances of the tenant.

How can LPC Cresa help?

At LPC Cresa, we help tenants across Australia and New Zealand with their commercial real estate needs, including transaction advisory, portfolio management and project management. In summary, we make sure tenant interests are protected and that our clients enter into tenant friendly lease agreements.

As the tenancy and leasing partner to the National Retail Association, Lpc Cresa offers NRA Members special NRA member rates on all advisory and leasing services.

You can contact Lpc Cresa through the National Retail Association on 1800 738 245.