In accordance with previous announcements, the next phase in the winding-back of the JobKeeper Payment Scheme takes effect from today, 4 January 2021.

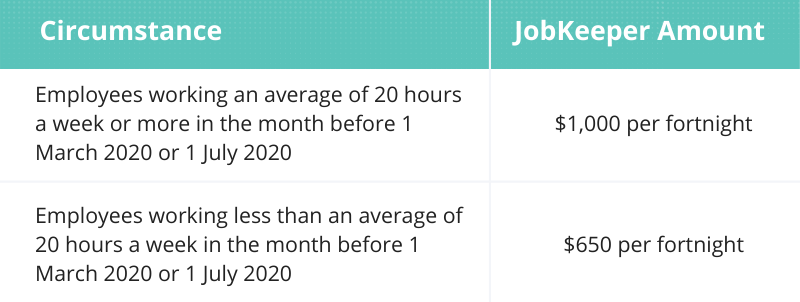

The amount of JobKeeper payments will be reduced as follows:

Businesses who have been receiving the payment also need to undertake the following tasks:

Re-assess business eligibility

Businesses will only receive the payment from 4 January 2021 if they have met the decline in turnover test.

This will be satisfied if the business’s actual GST turnover for the December 2020 quarter has declined by the appropriate amount compared to an equivalent period (usually the December 2019 quarter).

Submit the decline in turnover form to the ATO

This should be available on the ATO’s Business Portal from 4 January 2021 and must be completed before you can lodge your monthly declaration from 1 February 2021.

Pay eligible employees at least the JobKeeper amount

As with the previous rules of JobKeeper, employees must still be paid the full JobKeeper amount before the business can be reimbursed through the Payment Scheme.

There are no changes to employee eligibility criteria.

Notify employees of the payment rate which applies to them

You will have advised the ATO whether the higher or lower rate applies to an employee when you first claimed the payments after 28 September 2020.

You should still remind eligible employees of the change to the payment amount from 4 January 2021.

Review any JobKeeper-enabled directions

If a business is no longer eligible to receive JobKeeper payments, all JobKeeper enabled directions issued under Part 6-4C of the Fair Work Act 2009 (Cth) automatically come to an end.

This includes any direction to work reduced hours, to work alternative duties, or to work at a different location.

If a direction is automatically terminated in this way, the employee must be returned to their previous working arrangements with immediate effect unless alternative arrangements can be reached.

Please see the NRA’s FAQ on the JobKeeper Payment Scheme for more information about the kinds of workplace flexibilities that may be available to businesses no longer receiving JobKeeper (known as “legacy” employers).